- #Lookup ein by company name how to#

- #Lookup ein by company name professional#

- #Lookup ein by company name free#

If you are undecided on what business structure to choose, visit our How To Choose a Business Structure guide or our LLC vs Sole Proprietor guide.

#Lookup ein by company name free#

Visit our LLC before EIN guide to learn more.įor help with business formation, visit our free How to Form an LLC or How to Start a Corporation guides for step-by-step instructions. You will need to register your business and get approval for the business's name from your state before getting an EIN. The IRS will ask for your business formation date and legal business name. You must form your business before getting an EIN. The quickest and simplest way for taxpayers to get a free EIN is to apply online on the IRS website using the EIN Assistant. Most new businesses have a difficult time getting approved for a business credit card, but some credit card companies like BILL approve even new businesses.A business credit card is a great way to start building your business credit and acquire larger and more lines of credit down the road.Banks use EINs to approve you for a business credit card. An EIN acts like a Social Security number for a business.You need an EIN to get a business credit card. Learn more about why you need a business bank account and visit our best banks for small business review. You can also build business credit and qualify for more loans.

#Lookup ein by company name professional#

No matter what kind of business you have, it is usually a good idea to get an EIN number. Trusts and EstatesĮINs are used for specific types of trusts and estates under varying circumstances.

If your business structure is a nonprofit, you are required to have an Employer ID Number for tax reporting purposes. If you have a C corporation, your business is viewed as a separate entity and you are required to get an EIN for tax reporting purposes. If you have an S corporation tax structure, you are required to have an EIN for tax reporting purposes. If your business structure is a partnership or multi-member LLC, you are required to get an EIN number because the LLC must file a partnership return and provide K-1s to members of the LLC. Learn more about EINs for Single-Member LLCs. It’s still recommended (and sometimes required) to open a bank account, to hire employees later, and in order to maintain your corporate veil. Single-member LLCs are required to have an EIN if they have employees. If your business entity is a single-member LLC without employees (or excise tax liability), then you are not required to get an Employer ID Number. Learn more about EINs for Sole Proprietorships. It's recommended that taxpayers get an EIN number in order to open a business bank account, build business credit, and lower the risk of identity theft. Sole proprietors with employees are required to have an EIN.Ī sole proprietor who is hiring employees should start thinking about when to form an LLC. Our sole proprietorship to LLC guide can help you decide when to take the next step in growing your business. We harvest our data from various publically available data sources such as edgar database (SEC), form 5500 dataset (IRS), form 990 datasets (tax-exempt organizations) etc.If your business structure is a sole proprietorship without employees (and doesn’t file any excise or pension plan tax returns), then you are not required to get an Employer Identification Number (EIN).

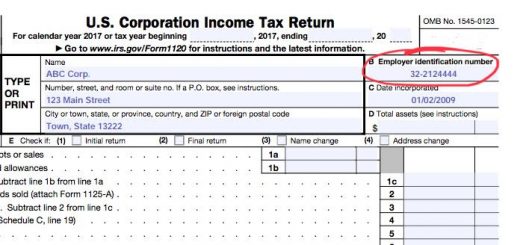

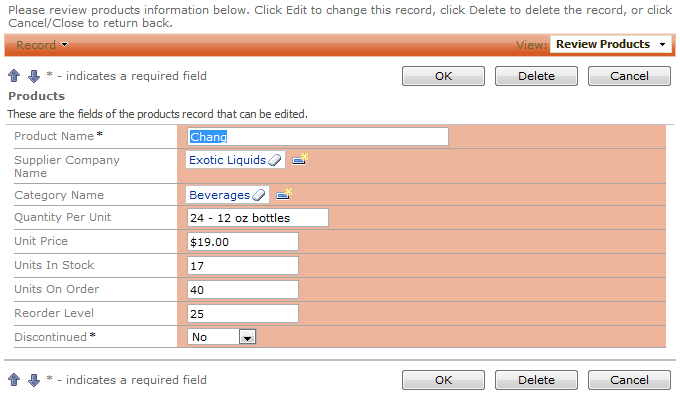

We have a database of over 7.3M entities which can be searched to find the ein number of business entities. What is ?: Our website is a free resource to find the ein number for various business entities. Since all corporations - including ones with no income - must file at least a federal income tax return, a corporation operating or incorporated in the United States generally must obtain an EIN anyway either before or after being issued its charter. Also, financial institutions such as banks, credit unions, and brokerage houses will not open an account for a corporation without an EIN. To be considered a Partnership, LLC, Corporation, S Corporation, Non-profit, etc. Other commonly used terms for EIN are Taxpayer Id, IRS Number, Tax Id, Taxpayer Identification Number (TIN) etc.Ī business needs an EIN in order to pay employees and to file business tax returns. Employer Identification Number (EIN): The Employer Identification Number (EIN), also known as the Federal Employer Identification Number (FEIN) or the Federal Tax Identification Number (FTIN), is a unique nine-digit number assigned by the Internal Revenue Service (IRS) (format: XX-XXXXXXXXX) to business entities operating in the United States for the purposes of identification and employment tax reporting.

0 kommentar(er)

0 kommentar(er)